Italian tiles exceed pre-Covid levels

Following a poor – albeit less negative than expected – performance in 2020, by the end of the first quarter of 2021 the Italian tile industry had already made up the lost ground and surpassed pre-pandemic levels. As Confindustria Ceramica Chairman Giovanni Savorani explains, the recovery began in the second half of last year, significantly mitigating the slump in sales experienced during the lockdown period.

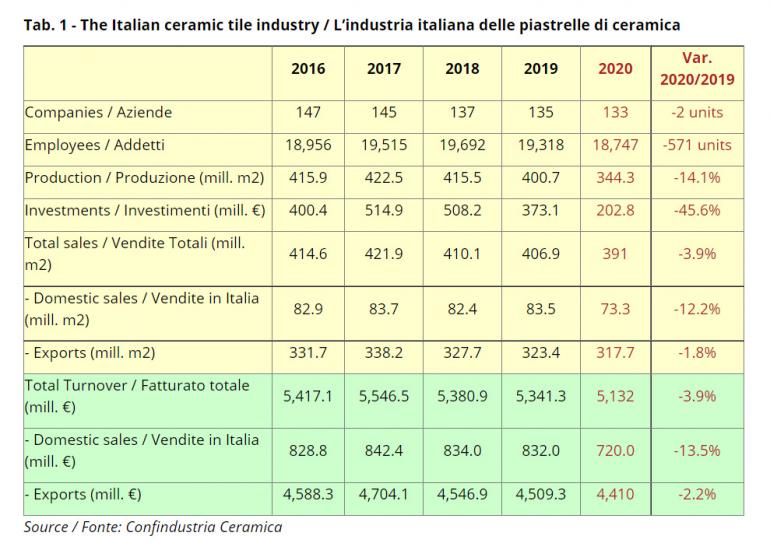

Compared to the negative signs that dominated the year of Covid (domestic tile production down 14%, total sales down 3.9% in both volume and value, investments almost halved, see Table 1), by 31 March 2021 all indicators had returned to decidedly positive territory.

Total turnover grew by 9% compared to Q1 2020, driven by a strong recovery in both Italian sales (+18.9%) and exports (+7.2%). These results were not just attributable to the expected rebound following the slowdown in 2020, but represented a real improvement (an approximately 7% overall increase compared to Q1 2019). “Our industry has shown great resilience,” said Savorani as he presented the figures at a press conference organised during Confindustria Ceramica’s annual general meeting. “In general, the growing interest in housing all over the world combined with the healthiness, sustainability and durability of ceramics has driven up global demand for tiles, and we have succeeded in tapping into that demand.”

Commenting on the double-digit growth recorded in the domestic market, Savorani confirmed that this was the first trend reversal after 15 years of steady decline. “There’s no question that +19% is an encouraging figure, even set against such a low starting point (720 million euros),” he said. “The incentives provided by the Recovery Plan and simplification of red tape can help make growth permanent and consistent, which is what we are hoping will happen, particularly considering that the 110% Superbonus scheme has yet to achieve its full potential.”

As regards the performance in international markets, which were also less impacted in 2020 with a loss of just 1.8% compared to 2019, Savorani explained that the best results in Q1 2021 were recorded in the European market, which is increasingly becoming the reference market for Italian-made tiles. “The recovery in the USA has been more timid,” he explained, “and the slice of the market freed up by Chinese exports (following the introduction of anti-dumping duties) has been more easily occupied either by local producers [mostly owned by large Italian groups, Editor] or by Spanish, Mexican and Brazilian products,” which are positioned at more similar price points. It is hardly a surprise that Spanish exports to the US grew by a further 10% in the first quarter of 2021.

While all indicators are currently pointing to a continuation of the positive trend recorded in the first quarter and consequently an equally favourable end to the year, Italian business leaders are concerned about other factors that have nothing to do with market demand.

“For our sector too, the recovery of the world economy has led to very sharp and sudden increases in the cost of production factors,” explains Savorani. “These include pallets, plastic and cardboard for packaging, as well as maritime freight, while we sometimes find ourselves unable to ship due to the lack of containers, which are concentrated more on the Pacific than Atlantic routes.

In the 8 months between September 2020 and May 2021, the cost of packaging board grew by 64%, packaging plastics by 156% and pallets by 68% (fig 1). As for sea freight rates, the cost of containers from Europe to the US East Coast rose from $1,576 in October 2020 to $3,359 in May 2021, a 113% increase that is having a severe impact on an industry that generates 26% of its sales overseas (fig. 2).

The cost of gas is another issue. “Natural gas has undergone a twofold increase,” says Savorani. “In addition to the rising cost of the gas itself – from 8 euros last year to 20 euros today – we also face an increase in CO2 costs determined by the ETS system, which have grown from 15 euros per tonne 10 months ago to around 50-55 euros per tonne today, in part due to financial speculation.” (fig. 3). The chairman of Confindustria Ceramica considers this to be a dangerous decision as it undermines the competitiveness of a sector that has always been strongly committed to protecting the environment and has devoted a sizeable portion of its investments to reducing energy consumption and environmental impact with tangible results. Savorani believes that “the ETS mechanism needs to be reformulated and the ceramic industry included among the sectors eligible for compensation for indirect costs”.

Amid these problems, the ceramic tile industry can draw consolation from the dynamism of the market and the fact that it will in part be returning to the Bologna exhibition centre when Cersaie reopens on 27 September. “Cersaie is a vital marketing event for our sector and I’ m very optimistic about the success of the show,” says Savorani. “Italian and European customers will be back, while the green certificates and Covid-free flights will make it easier for buyers from other countries to participate too.”